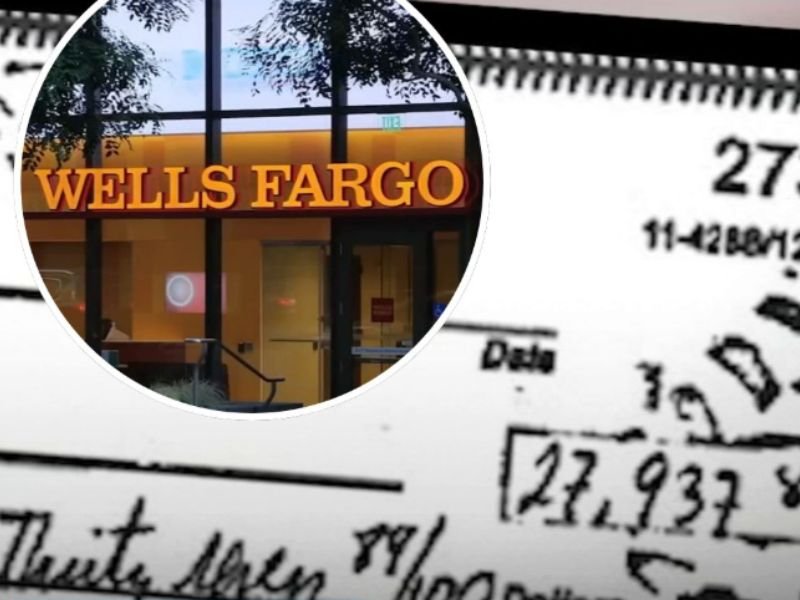

California Homeowners Say Wells Fargo Refused to Refund $28,000 After Mail Thieves Stole Santa Clara County Tax Check and Cashed It

CALIFORNIA — A couple in Santa Clara County, California says they are out $28,000 after mail thieves allegedly stole their property tax payment from the mail, rewrote the check with their own name, and cashed it — and they claim Wells Fargo denied their request for a refund, telling them it was “too late,” according to a report highlighted by ABC7 Bay Area’s “7 On Your Side.”

What the Homeowners Say Happened to the Property Tax Check

According to the report summary, the couple mailed a property tax payment check worth about $28,000. They say the check was stolen before it reached its intended destination.

The report claims the thieves then wrote their own name on the check and successfully cashed it, leaving the homeowners scrambling to recover the funds and figure out how their check could be altered and processed.

Why the Couple Says They’re Stuck Without a Refund

The key claim in the report is that Wells Fargo declined to reimburse them, saying the request came too late for a refund or recovery. The ABC7 segment summary suggests the couple is disputing that decision and seeking accountability for how the check was negotiated.

The report does not include all of the bank’s full explanation in the image provided, but it presents the issue as a dispute over responsibility and timing after a major theft.

How Check Theft and “Mail Fraud” Complaints Are Growing

Mail theft and check washing schemes have become a major concern in many states because criminals can steal outgoing mail, alter checks, and attempt to cash them quickly — sometimes before the victim even realizes anything is missing.

In cases like this, investigators often try to determine:

- Where the check was last tracked or handled

- Whether the check was altered or “washed”

- What identification was used to cash or deposit it

- Whether the bank had warning signs that should have triggered review

- Whether the victim reported it within required time limits

What “7 On Your Side” Is Investigating

The ABC7 “7 On Your Side” segment indicates it is looking into what happened and how the couple can respond when a bank denies a refund in an alleged fraud case.

Consumer advocates often urge victims to document everything — including when the check was mailed, when it was expected to arrive, when the account was checked, and when the fraud was first reported — because disputes can depend heavily on timelines.

What Midwest Families Can Learn From This Case

While this incident happened in California, it raises issues relevant nationwide — including in Illinois — because many households still mail:

- Property tax payments

- Contractor checks

- Medical payments

- HOA dues

- Other high-dollar paper checks

To reduce risk, consumer experts frequently recommend using:

- Online bill pay through verified portals

- Money orders or certified payments when required

- Dropping mail inside a post office (not in curbside boxes)

- Tracking payments quickly and checking accounts daily after mailing large checks

What Happens Next

The report suggests the couple is still pursuing answers and options after the denial. Future updates would likely clarify:

- Whether law enforcement identified the person who cashed the check

- Whether the bank reversed course after review

- What consumer protections applied based on timing and documentation

For more consumer-related stories that highlight real risks families face — and what you can do to protect yourself — visit NapervilleLocal.com and share your thoughts: should banks be required to do more when a stolen and altered check is cashed?

Naperville is a community with stories that deserve to be told — both the serious ones about safety and justice, and the lighter ones that capture our culture and daily life. I focus on covering crime reports and court updates while also highlighting the traditions, events, and social trends that shape who we are. Through my reporting, I want to give readers a fuller picture of Naperville — the challenges we face and the character that keeps our city strong.